Blog: Changing structures: A look at textiles and clothing

As one of the most affected sectors in the COVID-19 pandemic, can fashion retailers and manufactures adapt for the better?

The Great Shutdown has disproportionately affected the apparel sector. McKinsey estimates that revenues for the global fashion industry will contract by 27% to 30% in 2020 year-on-year.¹

End-consumer retail sales are heavily disrupted as most shops are currently closed in many important consumer markets. In France, consumer apparel expenditures decreased by 90% in March², with clothing sales expected to remain low in the months to come since consumers with full wardrobes regard clothing as non-essential. Online purchases can only partially compensate, if at all. Germany's e-commerce and mail-order business turnover dropped by more than 30% in March compared to the same months in 2019³. McKinsey reported that online sales have declined 5% to 20% across Europe and 30% to 40% in the United States. Some important apparel retailers such as Primark do not even have an online business.

A demand shock

Brands and retailers are passing this demand shock on to their suppliers, who often work in developing countries. Many brands and retailers are cancelling orders for the spring/summer season 2020, including orders already in production, for which fabric was prepaid and cut. Moreover, numerous brands and retailers often extend payment terms unilaterally, paying factories much later⁴.

The Bangladesh Garment Manufacturers Exporters Association states that by 26 April 1,149 companies reported suspended or cancelled export orders of 981 million pieces of garment, amounting to a value of $3.17 billion at manufacturing level, thereby affecting 2,27 million workers - the majority of them being women⁵. In India, current estimates of the total export business affected amount to $3 billion⁶.

A supply shock

In addition to this loss in demand, factories are experiencing a supply shock. Most least developed countries as well as most producers in the Middle East and Central America need to import fabrics and accessories for their export-oriented clothing sector. The majority of fabrics come from Asia, with some exceptions coming from Europe and the United States. The International Textile Manufacturers Federation reported that textile sales were down 31% on average across various regions.

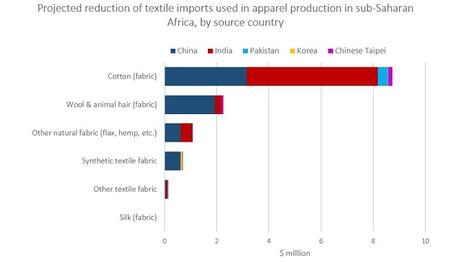

ITC estimates that textile mill closures in Asia will reduce the imports of vital fabrics for the export-oriented apparel industry in sub-Saharan Africa by approximately $13 million⁷.

Subject to confinement

As factories are crowded places, most countries have asked companies to close temporarily or, in case they still have to finish orders, to re-arrange production lines to respect the required distance between workers.

Consequently, many clothing manufacturers had to close down - for example, 80%-90% of all factories in Madagascar, Morocco or Tunisia.

Each crisis spurs structural changes and opportunities

Most countries worldwide outsource the production of medical textiles and protective gear. As the immediate need to have supply capacities starts at home, countries such as Morocco and Tunisia have started to produce masks, medical gowns and other protective wear. This strategic capacity will most likely not disappear in the future.

The value chain landscape in the textile and clothing sector is likely to change after the crisis. Structural changes are likely to accelerate, leading to further consolidation (fewer and larger brands/retailers with the financial muscles to survive the crisis). Larger buyers will deal with larger factories, therefore putting an additional constraint on micro and small businesses. To respond to this accelerating trend, small businesses need to diversify into high-value added products with small production runs and fast delivery, while further improving efficiency in producing basic items.

Market diversification becomes even more important. Many companies and sectors sell only to a few markets, in many cases to a single customer. These customers are usually located in Europe and the United States, both heavily affected by the lockdowns. Companies should therefore mirror what brands and retailers have already started doing. While brands and retailers are broadening their supply base, clothing manufacturers will need to supply multiple clients and markets, while exploring non-traditional markets. For instance, countries in the Middle East and North Africa could explore markets in sub-Saharan Africa. For least developed countries in Asia, the Chinese, Indian, Korean and Japanese markets could become interesting.

Nearshoring has already been a trend in the apparel sector that is likely to accelerate post COVID-19. Countries in North Africa and Eastern Europe should benefit from their proximity to the European Union, while Central American countries could benefit from their closeness to the United States to export more garments to these markets. Moving towards nearshoring requires enterprises to change operations, thereby accelerating the digital product development process to reduce costs and respond to markets rapidly. This would entail moving towards smaller production quantities and developing closer links with upstream textile and trim suppliers in the same county or region.

Corporate social responsibility might also need to be adapted. 'Important differences in the ethical buying behavior are becoming very apparent in the way brands and retailers are either simply dropping their suppliers or trying to confront this crisis in a more collaborative manner.'⁸

While brands and retailers should continue ensuring decent working conditions as well as responsible, environmental behaviour, they also need to respect the partnerships with factories they often emphasize.⁹

It is indeed time to rethink the way brands and retailers share the value along their supply chain. That starts with changing the belief of sourcing executives and buyers purchasing clothing in developing countries as well as of many manufacturers that the only way to remain competitive is to continually reduce free-on-board costs.¹º Brands and retailers need to work together with their suppliers to offer products that consumers are willing to pay at non-discounted prices. Brands and retailers then need to share the retained value more equally with their suppliers.

The present crisis will especially hit clothing manufacturers and their workers in developing countries along the value chain. However, each crisis offers opportunities if handled well: companies need to address the shortcomings that were already visible before the crisis. Brands and retailers need to embrace their suppliers as partners beyond the corporate social responsibility rhetoric. Together they can deliver the products consumers really desire and value while sharing the profit more equally.

¹ Business of Fashion and McKinsey "The State of Fashion 2020, Coronavirus Update, 2020, p. 7

² https://www.bfmtv.com/economie/coronavirus-la-consommation-des-menages-francais-chute-aussi-de-35percent-1882439.html

³ https://www.textilwirtschaft.de/business/news/bevh-bestaetigt-umsatzeinbruch-bei-e-commerce-modesegment-verliert-mehr-als-35-im-maerz-224978

⁴ https://www.workersrights.org/wp-content/uploads/2020/03/Abandoned-Penn-State-WRC-Report-March-27-2020.pdf

⁶ https://economictimes.indiatimes.com/news/economy/foreign-trade/covid-19-shipments-worth-usd-3-billion-at-stake-for-indian-apparel-exporters-says-survey/articleshow/75207063.cms

⁷ ITC calculations. Special thanks to Aissata Boubacar Moumouni, Consultant Economist, Research and Strategies for Export

⁸ Joint statement of the International Textile Manufacturers Federation and the International Apparel Federation found at https://www.iafnet.com/2016_01_22/wp-content/uploads/2020/03/20200327-IAF-ITMF-The-Impact-of-the-Corona-Virus-on-the-Textile-and-Apparel-Industry.pdf

⁹ The ITC Sustainability Map provides an overview of voluntary standards guiding suppliers on social and environmental sustainability.