Blog: The Great Shutdown: How COVID-19 disrupts supply chains

COVID-19 will reduce global exports of manufacturing inputs by at least $228 billion due to supply-chain disruptions

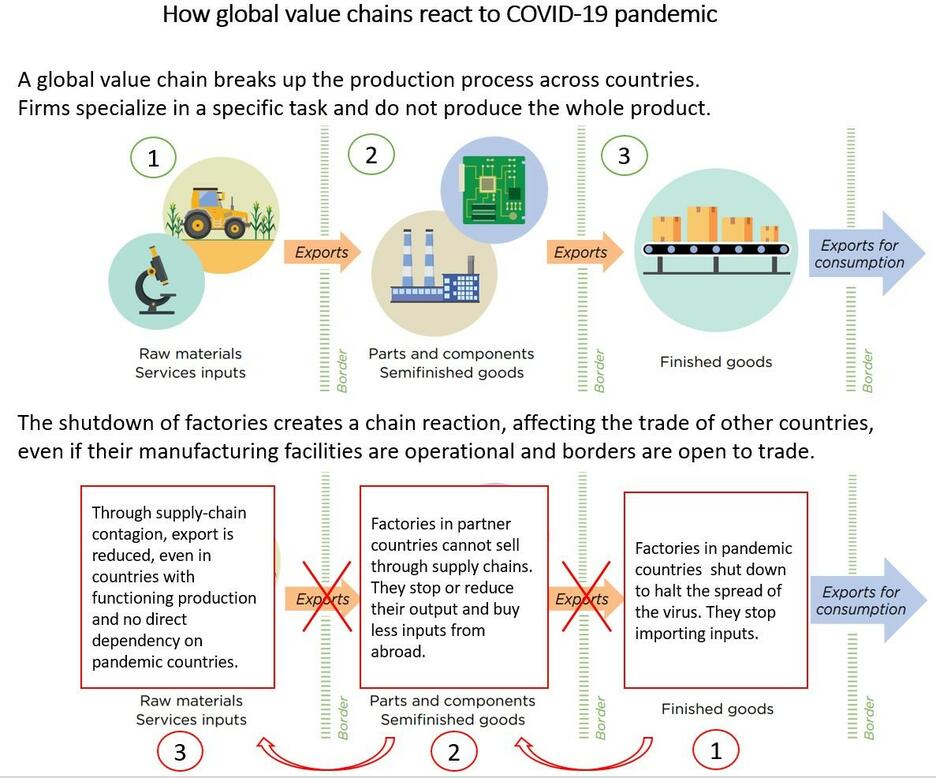

Over two-thirds of world trade occurs through global value chains (GVCs), in which production crosses at least one border before final assembly¹. The COVID-19 pandemic has already hit three major GVC hubs, or as we call them in this blog, the G3 – China, the European Union (EU) and the United States –, creating an unprecedented combination of supply and demand shocks. The decreased demand for inputs by the G3 factories will lead to lower exports of raw materials, parts and components by their partners.

Source: Adapted from the World Development Report 2020. Trading for Development in the Age of Global Value Chains. World Bank.

Our analysis sheds light on how the world’s export of inputs (raw materials, parts and components) within supply chains reacts to the shutdown of manufacturing facilities in the G3 and how the shock propagates to G3 partners. We keep aside the loss of exports for other reasons, such as factory shutdowns at home, reduced demand for final goods, or difficulties accessing inputs².

The European Union lockdown creates the largest supply chain shock

The factory shutdown in the EU will have the strongest repercussion for the supply-chain exports of other countries. Why? Because the EU is the largest importer of manufacturing inputs (China is the largest exporter), the largest market for three of the world’s five geographic regions, and highly integrated into global value chains. The EU is the main importer of manufacturing inputs from both Africa and Asia and buys almost as much of manufacturing inputs from Latin America as the United States does.

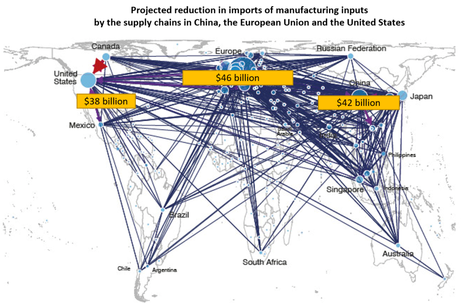

Our estimations suggest that EU imports of manufacturing inputs will drop by $147 billion, out of which $101 billion is intra-EU trade, and $46 billion is imports from other regions. China and the United States come second and third, with shutdowns in China and the United States triggering the reduction of imports of manufacturing inputs by $42 billion and $38 billion respectively (see the columns in the table below). The combined reduction amounts to $228 billion, or 2.4% of the total manufacturing imports by the G3, or 11% if only GVC trade is considered.

Source: International Trade Centre.

Countries in the Americas will export $24 billion less of manufacturing inputs, mostly caused by the pandemic-induced shutdowns of factories in the United States and the EU. The shock on Asia amounts to $71 billion, with the majority of loss stemming from the effects of the pandemic in China and the EU. Europe is primarily affected by the factory shutdowns within the EU, amounting to an estimated $128 billion loss of manufacturing exports due to supply-chain disruptions, most of which linked to intra-EU trade in manufacturing inputs. Exporters in Oceania are projected to lose $800 million in exports of manufacturing inputs (see the rows in the table below).

Supply chain disruption will cause a trade plunge in all regions

Notes: Darker colours indicate higher reduction. Percentages are shares of projected reduction in the total manufacturing trade (the total refers to 2019). The values for the European Union include the United Kingdom for consistency across periods. Projected supply chain disruption is calculated as the reduction of imported inputs by the G3, assuming a two-month long shutdown of all factories within the G3, and taking into account the direct effect only (one link in supply chains, i.e. the reduction of exports in countries supplying inputs to the G3).

Source: International Trade Centre.

Africa is less exposed to supply chain disruptions

African exporters may lose over $2.4 billion in global manufacturing value-chain exports due to the shock caused by factory shutdowns in the G3. About three quarters of this loss is caused by the temporary disruption of the supply chain linkages with the EU, while the remaining quarter of the reduction being caused by the shutdowns in China and the United States. When it comes to global value chains, Africa is one of the least integrated regions, and hence experiences the least severe effects of supply-chain disruptions originating in the G3.

Supply-chain disruption is strongest in machinery, plastics and rubber and electronic equipment sectors

The supply-chain disruption mostly affects the machinery, plastics and rubber, chemicals, and electronic equipment sectors. These sectors are likely to be the biggest losers in terms of value, with exports of manufacturing inputs dropping by $44 billion, $29 billion, $23 billion and $23 billion respectively (see values on the figure below). Looking at how big the loss is compared to the size of the sector, ferrous metals, mineral products, synthetic textile fabric, and glass articles top the list. We estimate that the loss of exports of manufacturing inputs due to supply-chain disruptions will exceed 7% of the total export value of these sector.

Sectors with production spread across borders will be hit most by supply-chain disruptions.

Notes: Percentages are shares of projected reduction of GVC imports in the total manufacturing imports of the G3 (the total refers to 2019). The value for the EU include intra-EU trade. The values for the European Union include the United Kingdom for consistency across periods. Projected supply chain disruption is calculated as the reduction of imported inputs by G3, assuming a two-month long shutdown of all factories in the G3, and taking into account the direct effect only (one link in supply chains, i.e. the reduction of exports in countries supplying inputs to the G3).

Source: International Trade Centre.

Rethinking supply chains

The economic consequences of the Great Shutdown are likely to trigger a rethink of how supply chains function, putting the emphasis on resilience. Reinforcing regional operations by shortening supply chains and staying closer to the consumer is one of the possible strategies . Yet, the resilience does not need to rely on self-sufficiency, and reinforcing regional integration is not a call for anti-globalism.

The return to full production requires re-establishing existing links, removing temporary barriers put in place during the emergency, and ensuring an open and predictable world trading system. Immediate attempts to onshore tasks or relocate them closer to home may delay restoring full production because finding alternative suppliers for specialized parts and waiting for deliveries in a travel-restricted world will be lengthy, costly and marred by uncertainty. Furthermore, switching away from the G3 hubs will not be fully effective as their scale of production is hard to compete with.

The solution to the current supply chain disruption and the preparedness for future shocks lies in creating more resilient businesses and more robust links, and not in reducing the size of the system.

¹ World Bank; World Trade Organization. 2019. Global Value Chain Development Report 2019: Technological Innovation, Supply Chain Trade, and Workers in a Globalized World (English). Washington, D.C.: World Bank Group. http://documents.worldbank.org/curated/en/384161555079173489/Global-Value-Chain-Development-Report-2019-Technological-Innovation-Supply-Chain-Trade-and-Workers-in-a-Globalized-World

² In this analysis, we focus on the export of manufacturing inputs within supply chains, defined as inputs used in the production located in at least three countries (or crossing two borders). We exclude final goods, inputs that go into final goods, and inputs that go into goods that are sold domestically. To put the concept in perspective, the world’s export of manufacturing inputs within supply chains in 2019 amounted to $2.2 trillion, corresponding to 12% of all manufacturing trade. For further methodological details and other enquiries contact Olga Solleder at solleder [at] intracen.org.

³ See SME Competitiveness Outlook 2017 for further details on regional value chains. ITC. 2017. SME Competitiveness Outlook 2017. The Region: A door to Global Trade. Geneva: ITC http://www.intracen.org/SME-Competitiveness-2017/