Gathering evidence on barriers to trade

Factors such as technical regulations, product standards and customs procedures still prevent limitless exchange of goods across countries. Such non-tariff measures (NTMs) are less visible and more complex than tariff protection measures, and are particularly burdensome for companies in developing countries that do not have the capacity to comply with the imposed rules and regulations. The business sector and trade policymakers are concerned that NTMs pose real obstacles to trade and any preferential international market access that companies from developing countries might enjoy could easily vanish without delivering the desired effect.

Existing studies use data at the country level to consider the effects of NTMs, but do not capture the experiences of exporters in their daily operations. In recent years, research has shown convincingly that there is substantial heterogeneity across companies. There is also robust evidence that only the most productive companies within an industry are able to serve difficult markets that are geographically remote and feature unfavourable economic conditions or a lower level of institutional quality. Similar reasoning applies to how companies experience NTMs. Whether a company manager considers a measure to be burdensome or not depends to a large extent on the situation of the particular company. In other words, even though NTMs are applied by countries, the perception of NTMs as burdensome in export markets may be subject to company-specific characteristics.

Since 2010, ITC has been conducting surveys on NTMs at the company level. Trading companies in developing countries are asked about the barriers they face in their daily business as well as the reasons why they experience a particular measure as burdensome. The resulting dataset is unique as it provides comparable and consistent cross-country and cross-sector information on companies from developing countries. It also identifies at the product level the measures these companies perceive as barriers when doing business in foreign markets.

Company types affected by NTMs

A few company characteristics were determined at the telephone screening stage of the ITC surveys. These characteristics can be used to study variations in the likelihood that an individual company will face a cumbersome NTM. For example, companies were asked to specify their number of employees, export status, location and main activity, essentially 'producing' or 'other', which mostly entailed trading and forwarding. As these variables were not all available for each of the 12 countries surveyed, ITC focused on information from three countries, namely Egypt, Madagascar and Mauritius. In these countries it was possible to identify the entity responsible for managing export and import procedures.

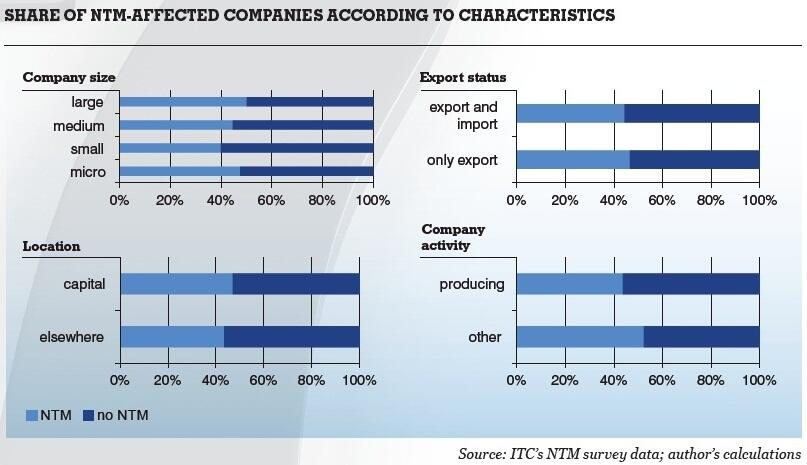

Based on survey information from exporters that are responsible for dealing with their own export procedures, the share of companies facing at least one NTM while exporting can be shown in relation to the size, export status, geographic location and activity of the companies. Surprisingly, the graph related to company size shows a U-shaped pattern, with the largest share of companies reporting burdensome NTMs among both the smallest companies, with fewer than 11 employees, and the biggest ones, with more than 250 employees. Likewise, differing export status does not indicate a significant difference in the share of companies facing at least one NTM, suggesting that pure exporters and companies that simultaneously export and import are affected to a similar extent. Both of these results are likely to be influenced by the observation that large companies and two-way traders serve more products and more markets. Therefore, the probability that they will encounter at least one obstructive NTM is high, even though they have greater capacity than small companies to deal with export procedures.

In addition to company size and export status, location may play a role in the effect of NTMs on companies. As government and public agencies are often clustered in the capital of a country, establishing headquarters in the capital could facilitate access to information. Challenging this argument, the graph showing NTMs relative to company location reveals that the share of NTM-affected exporters is slightly higher for companies located in the region of the capital city than for those located elsewhere in the country. Finally, differences occur in relation to the activities of companies. On the one hand, trading companies may be more specialized and have more experience in dealing with export procedures than producing companies. On the other hand, producers have detailed knowledge of their products and production processes, which may facilitate their compliance with international standards. Further, customs issues affect a larger share of traders' and forwarders' activities. On this basis, a producing company's interviewee may perceive NTMs to be less burdensome. The graph covering company activity suggests that the share of producers facing burdensome NTMs is considerably lower than the share of other types of companies, including traders.

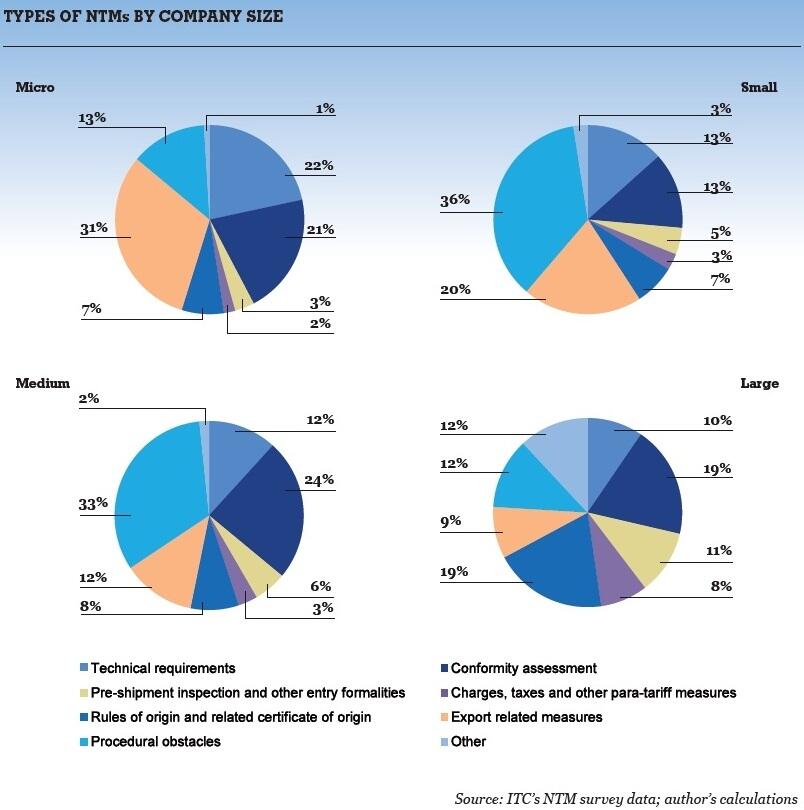

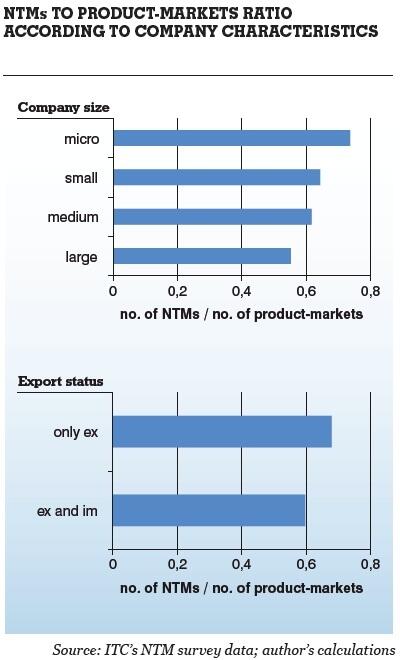

The results of the study covering company size and export status may hinge on the difficulty of distinguishing company-level capabilities to overcome bottlenecks caused by confrontation with at least one NTM when a product and market dimension is not taken into account. Considering the ratio of NTMs to product-markets in relation to company characteristics, the share of NTMs is highest for micro companies and pure exporters, which face an average of 0.74 and 0.68 burdensome NTMs per product-market respectively. In contrast, large companies and two-way traders face an average of 0.55 and 0.60 burdensome NTMs per product-market respectively. The types of burdensome NTMs differ by company size. Technical requirements, which represent a fixed market-entry cost, are particularly troublesome for micro companies as their small export volumes translate into large per-unit costs of compliance with the requirements. In turn, charges, taxes and para-tariff measures, which represent variable costs that increase relative to the export level of a company, account for a significant share of large companies' reports on obstructive NTMs. Although this information is not available for all firms interviewed at the telephone screening stage of ITC surveys, it does support the perspective that how companies are affected by NTMs varies depending on their characteristics.

Policy implications

The elimination of NTMs has gained importance on the international trade agenda. In the light of low overall levels of tariff protection, there is a fear that NTMs could represent major trade obstacles and influence market access conditions. These company-level findings have important policy implications that complement earlier insights on NTMs gained at the country or sector level. Clearly, an attempt to mitigate NTMs should not be tackled merely at an aggregate level. While a sector or a country-wide approach may be a useful starting point, it will not be suitable for every company. Instead, the ITC findings stress the need to design policies that moderate the impact of trade obstacles on different types of companies.