Trade facilitation, international supply chains and SME competitiveness

As the relevance of international value chains continues to grow within the global economy, international trade increasingly takes place within the production networks of multinational corporations. According to estimates from the Organisation for Economic Co-operation and Development (OECD), imported intermediate inputs account for about one-quarter of OECD members’ exports. For China, this share is about 30%; it is about twice that for India and Brazil. From a national perspective, participation in value-chain trade has many benefits. Beyond export revenue and employment, value chain trade creates indirect spillovers in areas such as management, technical know-how, and access to new technologies that go beyond those accrued by trade in final goods.

The rise of cross-border value chains has important implications for countries’ economic and trade policies as well as for development efforts. One consequence is that cross-border trade in goods has become increasingly intertwined with trade in services and cross-border investment flows, as well as with the international movement of labour. Another effect is that a country’s export volumes increasingly depend on national efforts to remove the obstacles to trade in goods, in other words, on trade facilitation.

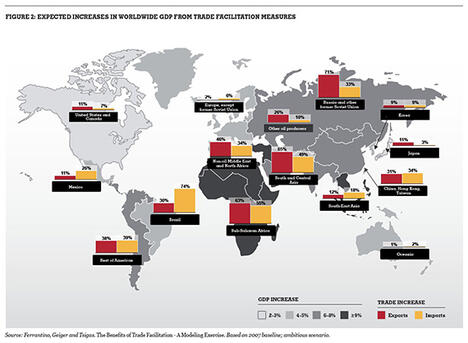

As intermediate products cross borders many times before being assembled into a final good, logistics costs are key for export competitiveness. The Enabling Trade: Valuing Growth Opportunities programme, conducted by the World Economic Forum, the World Bank and Bain & Co. in 2012, indicated that reducing supply chain barriers could increase global gross domestic product (GDP) by US$ 2.6 trillion, around 5%. This estimate relies on countries improving just two key areas of trade facilitation – border administration and transport and communications infrastructure – halfway to global best practice. A less ambitious scenario, that of improvement halfway to regional best practice, would already lead to a global GDP boost of approximately US$ 1.5 trillion, or 2.6% (see figure 1). The highest relative GDP gains are focused in Africa and South-East Asia (see figure 2).

Particular success would be expected for small and medium-sized enterprises (SMEs), for which the transaction costs associated with international trade and entering new markets are particularly high. This is for two reasons. The first is that there are economies of scale to be had in logistics services and administrative procedures; for example, administrative fees often apply per procedure and do not depend on the value traded. The second reason is that SMEs may not have the possibility to dedicate staff to following administrative procedures, further increasing the informational and procedural burden.

Click on image to view full size

A fascinating study conducted last year by eBay to virtually remove the trade barriers faced by their small-business sellers showed cross-border trade growth of 60% to 80%. As e-commerce expands across the world, this small-business experience becomes increasingly important.

Parallel to this technological development, a complete shift to electronic rather than paper-based systems in trade management is overdue. Further global harmonization of data standards can assist in this, but incomplete standardization should not be a roadblock. Many trade facilitation improvements can be made unilaterally.

Importantly, successful participation in international value chains requires ease in importing as well, which in many developing countries is still too constrained by tariffs and other trade barriers.

More recent and deeper investigation of supply chain planning – both in global multinationals and companies which are not yet exporting but would like to – reveals a new focus. Just as the reform drive shifted from tariff reduction to border management concerns, the new emphasis is on modularity and replicability behind the border. Both experienced and budding exporters are keen to be able to set up their sourcing and distribution systems in a harmonized way across countries. Ongoing research indicates that the key to this may be to convince officials in domestically focused ministries and industries that trade facilitation should be part of their portfolio of concerns, rather than someone else’s problem.

Countries able to facilitate this plug-and-play approach for global value chains find it to be a growing source of trade competitiveness. At the multilateral level, the proposed agreement on trade facilitation currently under negotiation under the auspices of the World Trade Organization (WTO) has the potential to significantly enable trade in goods by making regulations more transparent, facilitating transit and customs procedures. A successful agreement on trade facilitation at the WTO Ministerial Conference in Bali will particularly benefit SMEs in developing countries, as their competitiveness currently suffers over-proportionally from the frictional costs of trade.