Youth for Youth: Financing is possible!

Trade Forum talked with three young researchers from the Graduate Institute of International Development Studies in Geneva to find out which challenges young people are facing when trying to get financial support.

As part of ITC’s collaboration with the Graduate Institute, called Capstone Project, read what the young students suggest policymakers and investors should do differently – to give youth a chance.

Access to finance is one of the major obstacles that youth face when starting their businesses. Financial providers, such as banks, consider start-ups a high-risk investment. However, young entrepreneurs are crucial drivers of any country’s economic growth. It should be in the government’s interest to promote these businesses.

ITC’s Youth and Trade Programme addresses this challenge. The team asked us to find solutions based on research and data that could help young entrepreneurs, with a focus on Kenya, Nigeria and the Philippines.

We looked at three focus areas: identifying the financial needs and challenges of young entrepreneurs and financial providers in the target countries, reviewing youth inclusive policies in different countries that have been successful in increasing access to finance, and determining government interventions that would be feasible and in the best interests of all stakeholders in the target countries.

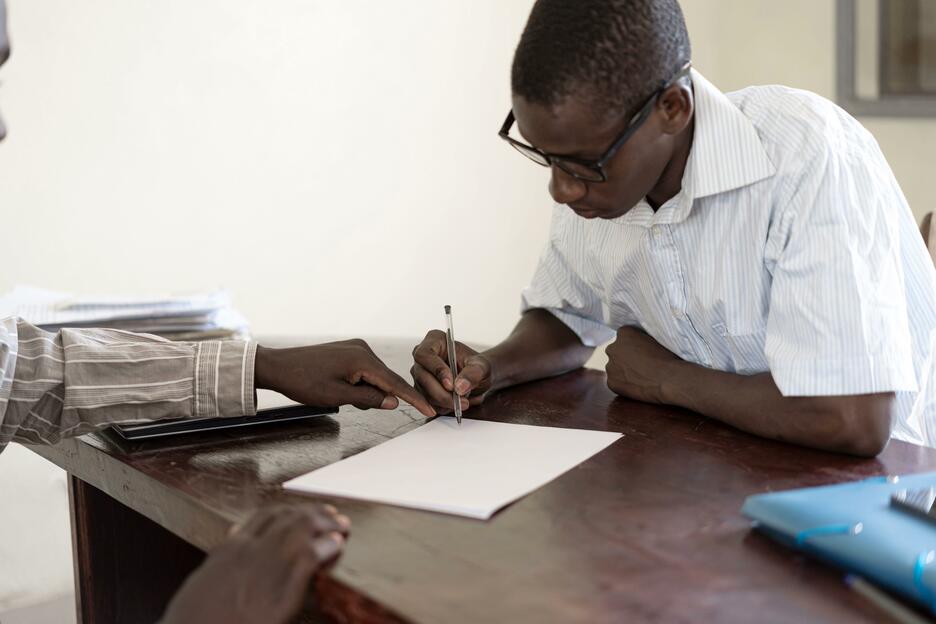

To cover all aspects of our research focus, we conducted 12 semi-structured interviews with entrepreneurs, business support organizations, investors, government representatives, risk analysts and an expert on access to finance. We also used data from surveys conducted by ITC and the World Bank and undertook an extensive literature review.

As young people lack credit history, do not have collateral and have limited business experience, financial providers consider them high risk, hence they are hesitant to invest in them.

Youth also lack information about alternative financing opportunities, while investors lack knowledge on the young entrepreneurs profiles, their sectors and their likelihood of success.

Even though training is available for youth, that does not translate into securing funding as trainings vary in effectiveness when it comes to developing skills that financial providers deem necessary.

Existing successful policies generally involve both an educational component for youth entrepreneurs and an incentivizing and de-risking component (tax breaks, loan guarantees, loan subsidies) to involve the private sector.

We recommend a three-module solution to 1. disseminate information, 2. identify quality trainings and mentorship programmes, and 3. de-risk and incentivize investment.

Specifically, this would mean:

1. To develop a national, centralized, low-cost information platform available to entrepreneurs and financial providers. This platform would act as a database for funding possibilities and offer mentorship and training opportunities while collecting essential financial and business information about the entrepreneur. This would help build the financial credibility of the youth entrepreneurs and increase their consideration as viable clients for financial providers.

2. To establish a certification scheme that would act as the common standard for training and mentorship programmes to help youth entrepreneurs and funding providers identify high-quality training. Once the young entrepreneurs have completed these programmes, financial providers can be assured that their skills are adequate.

3. To introduce loan guarantees for banks, tax breaks for investors and loan subsidies for youth entrepreneurs to help incentivize and de-risk investment into youth businesses. This would also attract private-sector funding. Their engagement plays a crucial role to ensure the sustainability of this strategy.

Finally, the eligibility for funding for a youth entrepreneur through government financing mechanisms would be conditional on educational attainments or accomplishing the certified training or mentoring schemes. Similarly, a bank’s eligibility to seek a loan guarantee may be conditional on the youth-friendliness of the loan product.

For questions, feel free to reach out to the authors %20aayushi.rawat [at] graduateinstitute.ch (Aayushi Rawat), franziska-sophie.heigel [at] graduateinstitute.ch (Franziska-Sophie Heigel) and ming.li [at] graduateinstitute.ch (Ming Li).