Measuring trade in goods and services

The rapid spread of global value chains (GVCs) since the end of the 1980s has changed the nature of international trade. Such value chains have opened a new era of international competition, reworking the organization of multinational firms and national economies. The interconnectedness of production processes that cross many countries has also defined a new division of labour, with each segment of the supply chain specializing in a particular set of production functions. In the process of change, new production and trade opportunities have been created in developing countries, while firms in industrialized economies have been increasingly focusing on the core value-added segment of their business.

The rise of production capabilities in emerging countries and a greater facility for doing business globally have generated additional options for outsourcing work, and new industrial players have come on to the field. One of the most visible consequences of GVCs has been the shift of large portions of manufactured production from industrialized countries to emerging economies, particularly in Asia. In the new international context shaped by GVCs, it has become difficult for national industries and national economic policies to remain self-contained systems.

Also of critical importance to policymaking is that trade within GVCs remains largely unchartered statistical territory. Until recently, there was a lack of data to support an understanding of the extent and implications of the structural change. By allocating the entire value of an import to the last country in the value chain, irrespective of the origin of the various parts and components incorporated in the final good, traditional statistics mask the economic origins of the value added at each step along the supply chain and imbedded in the product. When industries are integrated into GVCs and a large share of intermediate inputs are imported, traditional valuation based on custom registers may significantly skew the economic relevance of bilateral trade flows.

A series of international initiatives that crystallized in the release on 16 January 2013 of a database dedicated to the measure of global trade in value added by the Organisation for Economic Co-operation and Development (OECD) and World Trade Organization (WTO) has bridged the statistical gap. With new data it is now possible to better understand bilateral trade flows and avoid misinterpretation or inadequate policy decisions as the data sheds light on the contribution of individual sectors and countries to the generation of value-added content worldwide.

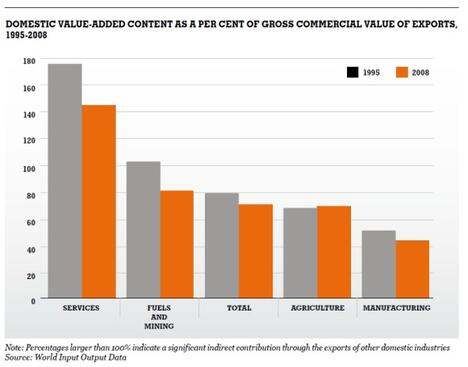

By measuring only value added, it is possible to resize world trade by taking out double counting. Total value-added exports in 2008 were about 70% of total gross exports. In other words, some 30% of total trade is made of re-exports of intermediate inputs. The difference between value-added and gross export figures, known as the VAX ratio, has decreased by around eight percentage points since 1995, suggesting the increased global interdependence of national economies.

Estimating the domestic content of exports implies measuring not only the added value brought by the exporting industry itself, but also the contribution of domestic suppliers that provide the exporting industry with intermediate goods and services. Here, not all sectors are affected in the same way. Some industries use inputs quite intensively, either purchased from other domestic industries or imported from abroad, while others are less dependent on intermediate inputs. As would be expected, trade in manufactured goods shows the greatest effect of international outsourcing. The VAX ratio of the manufacturing sector, already the lowest of all sectors in 1995 at 50%, decreased to 42% in 2008. The extractive industries also became increasingly reliant on imported inputs during this period, while very little change was perceptible in agriculture.

The most impressive results relate to services, a sector that has sometimes been classified by economic theory as non-tradable. In fact, services are a critical part of GVCs. By facilitating the transit of intermediate goods along a supply chain and making communication and coordination between its respective productive units possible, services provide the conveyer belt that keeps supply chains moving. In addition, domestic manufacturing industries that are first- or second-tier suppliers to international supply chains purchase services from local providers, be they utility, logistics or business services. Thus, the actual contribution of services to the gross output of goods producing industries is high; but this contribution is hidden in traditional trade statistics as the cost of services input is embedded in the final price of goods.

The VAX ratio of global exports of commercial services is well above 100%, suggesting that in the cost of production of manufactured goods there is significant value added purchased from services suppliers that is then embedded in the trade in goods. In other words, a large share of the value of goods purchased worldwide comes from the services sectors. It should also be noted that services are subject to international outsourcing. The VAX ratio for services declined by 30 percentage points between 1995 and 2008, indicating that services, much like goods, are being disaggregated and traded internationally as separate tasks. Some developing countries, such as India and the Philippines, have been able to seize this opportunity and develop global exports of business services.

Click on the image to see the full size

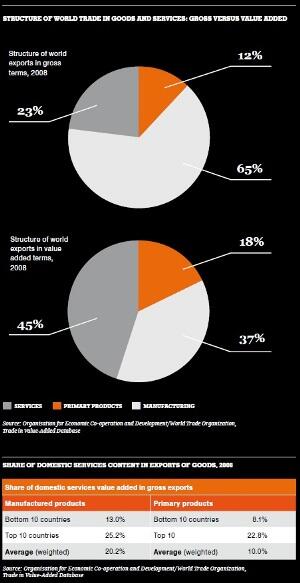

The participation of services in world exports doubles when trade in value added is measured instead of gross commercial price. As can be seen in the graphics covering the structure of world trade, services are the largest contributor to the value of global trade, while the share of manufacturing is reduced. This result has two important implications for economic policy:

• The first relates to employment.In modern economies, most jobs are found in the services sector, while the role of manufacturing as an employer has been shrinking. This is the result of technical progress and the related increase in labour productivity. Because trade in value added is also referred to as trade in tasks, the results indicate that many more jobs are related to trade than was previously believed to be the case.

• The second relates to services. Services play a crucial role in determining the international competitiveness of domestic goods producing sectors. When a large share of the final cost of production of a manufactured product is due to embedded business services, the cost and quality of the services becomes a key determinant of international competitiveness, especially for the higher value-added segment of the market.

The contribution of services to domestic export content varies according to sectors of activity and is much higher in manufacturing than in primary products. An average across all countries shows that the share of value added from domestic services in the total gross value of manufactured exports was about 20% in 2008, compared to 10% for primary products. This average result hides large differences from country to country as shown in the table of domestic services content in exports of goods.

In some economies, the domestic services content in the gross value of exports of primary products can be as high as 23%. The top 10 countries in terms of services content include advanced economies, such as Australia, France, New Zealand and the United States, as well as some developing countries, such as Brazil and South Africa. This is important and encouraging when analysing the trade and development multipliers for developing countries that have a rich pool of natural resources.

The OECD-WTO database on measuring trade in value added will progressively include more countries and become more granular. An additional line of work on GVCs contemplates measuring the related generation and transfer of income, either through profits or worker compensations. Once the trade, employment and financial implications are properly mapped, the underlying contributions of trade to development will become more apparent, benefitting not only participants and potential players in value chains, but also policymakers seeking to secure sustainable global governance.