WACOMP's financial empowerment event to boost agribusiness in Sierra Leone

Agribusinesses in Sierra Leone need better access to finance, but they also need ways to understand what kind of finance will work for them. Two events for government agencies and financial institutions highlighted how they can support business leaders to assess their finance needs and how to make sure they’re ready to use the funds.

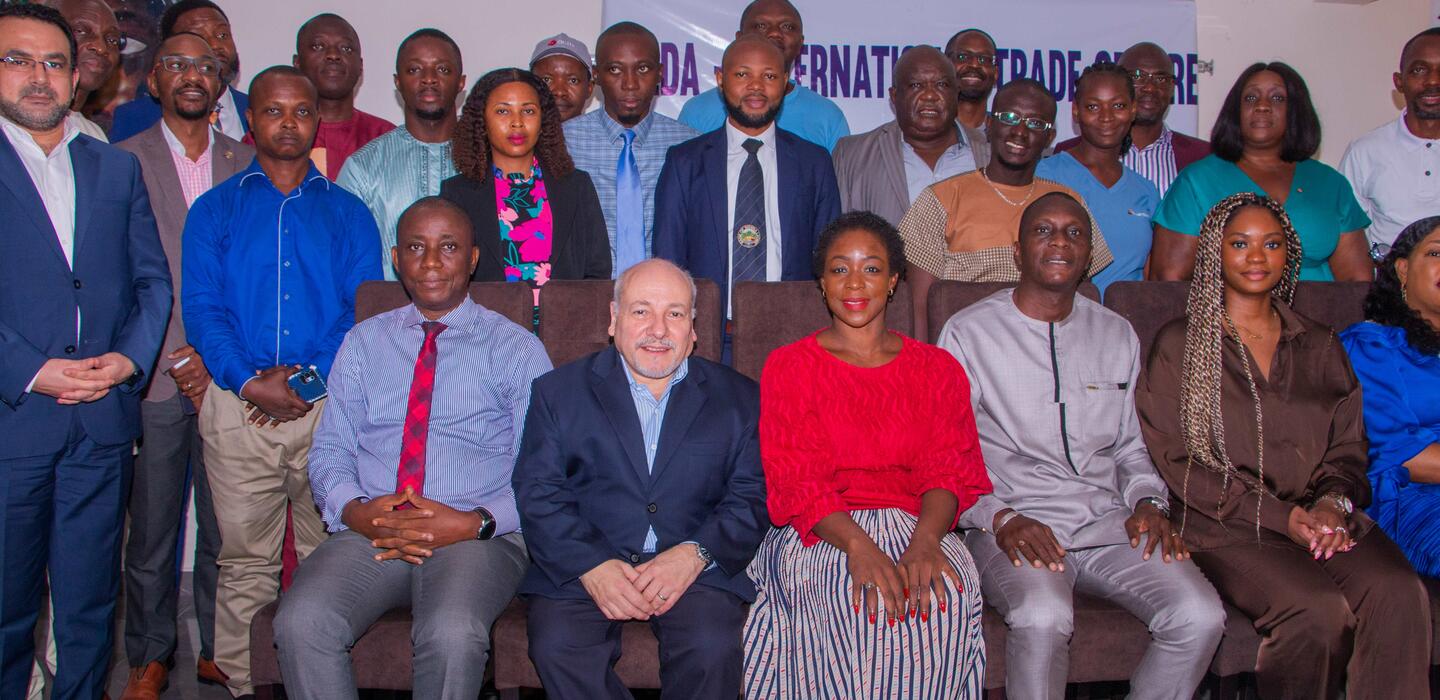

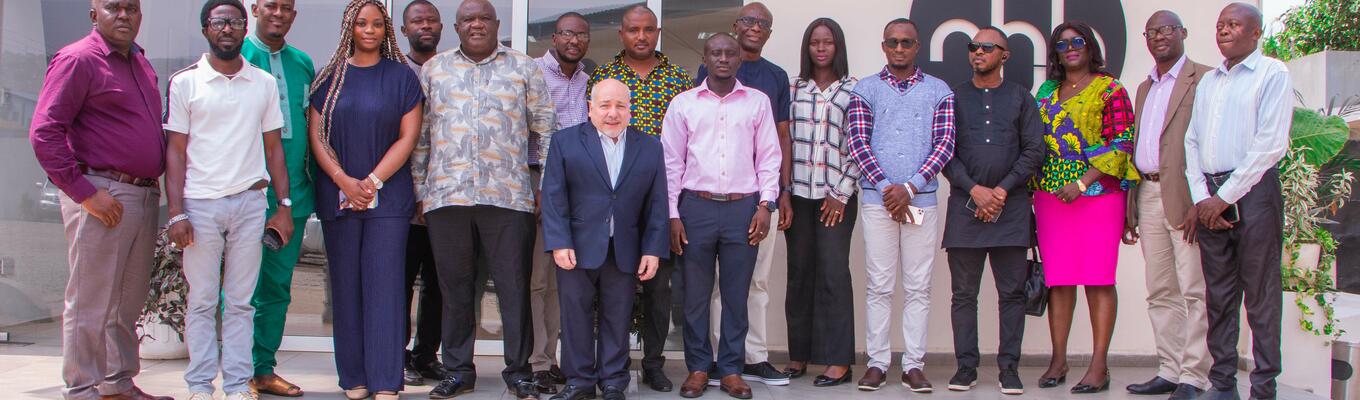

The International Trade Centre (ITC) and the government’s Small and Medium Enterprises Development Agency (SMEDA) hosted the events from 6-8 February 2024 in Freetown.

Access to finance is a key pillar of the ITC West African Competitiveness Programme (WACOMP).

The programme uses ITC’s extensive suite of online tools and data to help small businesses improve their operations and tap into global markets.

A workshop with SMEDA demonstrated the Business Diagnostic and Benchmarking Tool, customized to assess and address the specific needs of businesses in Sierra Leone.

Through hands-on training, SMEDA staff learned to use the tool so they can guide small businesses in assessing their financial needs and developing strategies to improve access to agricultural finance.

Karim Koroma from SMEDA said, ‘I will use the knowledge gained to assess, review, and develop recommendations for growth.’

Another participant, Augustine Macarthy, expressed his commitment, stating, ‘I will be using the diagnostic tool and what I learned during the workshop to improve MSMEs' understanding of their needs and the importance to their businesses.’

Subsequently, SMEDA spearheaded an event titled: ‘Unlocking access to finance for agri-based enterprises in Sierra Leone’. That event included agribusinesses and financial institutions such as Bloom Bank. Non-government organizations and UN agencies like the UN Capital Development Fund discussed their efforts to develop agricultural insurance.

The event also highlighted government policy initiatives for promoting financial inclusion. A live demonstration of the Business Diagnostic and Benchmarking Tool showcased its practical application and how it can prepare small businesses to access crucial capital.

Overcoming challenges in agricultural finance

Financial institutions later discussed the challenges faced by small businesses in agricultural value chains. That panel discussion revealed obstacles such as investment readiness, knowledge gaps, infrastructure limitations, and policy inefficiencies. Possible solutions included leveraging insurance facilities, disease control policies, tailored loan products, collaboration among financial institutions, and policy advocacy.

Additionally, the event showcased collaboration by ITC and SMEDA in addressing finance accessibility. A highlight was the introduction of the Financial Sources Guide, a comprehensive resource of funding avenues for small businesses. This guide gives invaluable insights by bringing together traditional bank loans, government grants, and innovative options like venture capital.

As the event concluded, networking sessions provided a platform for collaboration, sparking connections, and fostering a spirit of mutual growth among participants.

This event represented a step forward for Sierra Leone's agribusinesses under the WACOMP Sierra Leone programme, contributing to the region's economic growth by fostering financial inclusion and empowering small businesses.

About the project

The West African Competitiveness Programme (WACOMP) in Sierra Leone aims to enhance the competitiveness of the cocoa, palm oil and cassava sectors to boost the country's connection to regional and global value chains, create more jobs and strengthen its resilience against economic chocs. It is funded by the European Union and implemented in partnership with UNIDO.